Personal loan in UAE 3500 salary for non-listed company

In our daily lives, there are numerous personal expenses that disturb the financial budget. The proper tackling of this situation in an accurate way is crucial. In the UAE, financial institutions offer the most suitable types of loans for all the borrowers’ needs of finances. One of the types is a Personal Loan that covers all sorts of expenses including paying bills, weddings, and any emergency need. There is no need for any collateral because of its unsecured nature. The banks have issued a specific list of listed companies. The advantage of these companies is that lenders trust more on the applicants of listed companies.

But, the question is what an employer of a non-listed company should do for getting a personal loan. Now, there is much advancement in the market of finances. The banks and online lenders also have the objective of offering loans to non-listed companies as well. The eligibility criteria must meet and with the proper submission of the application form & all documents.

In general, a Personal loan in UAE 3500 salary for non-listed company is also available. Before applying, you should know the maximum limit of debt amount of lenders with their requirement of monthly salary. Loansforgulf offers personal loans to all applicants including a listed or a non-listed company. With a salary of more than 3500 AED, you can avail of this loan.

Get personal loans with a salary of 3500 AED in the UAE

Yes, personal loans with 3500 AED per month salary are offered by various lenders. The easier way of checking the limit of monthly salary is through the official websites of the banks & lenders. But, the fulfillment of their criteria is compulsory. If anyone fails to meet any of their criteria, you will not get a chance of receiving the debt. As a result, your stress of financial issues will never reduce. You have to choose an authentic lender with the loan amount of your choice.

Features of a Personal Loan for Non-Listed Companies

In this article’s section, you will know about some unique features of this loan. Every listed company can enjoy the features because they are exceptional to solve borrowers’ financial issues. After taking the loan, you will definitely never regret it. The dominant features are:

Loan amount:

The banks/financial institutions set their particular limits for providing the loan amount. But, their first preference is to check the borrower’s record of employment in a well-established company. No matter, if the company is listed or not. The company must have a good working record. Moreover, the lender considers your monthly income for the approval of the loan amount.

As compared to the listed company’s employers, the maximum amount for an applicant working without the listed company is lower. The availing of small debts is quite easier for such borrowers. This step is for the bank’s security so that borrowers can easily pay off. However, if the clients are trusted, the lenders will not hesitate to provide loans to them. Not all lenders’ limit of maximum debts is similar. You should know about it if you are planning to apply for higher debts.

Maximum Tenure:

The loan tenures are the same for every applicant. The personal loans for any non-listed company are with a maximum tenure of more than four years. A period of at least 48 months is enough for every borrower to manage their financial budget including the repaying amount. The interest rates are not higher. That’s why there is no need of worrying about the higher monthly installments.

Benefits to get personal loans

The availing of a personal loan is not ideal in its features but also it comes with numerous benefits. The lenders take care of the applicant’s needs. It is the biggest reason for their providing some additional benefits with the loan. The banks offer free credit cards with this loan type. Besides, Loansforgulf is an ideally perfect financial company that gives relaxation to its clients because of easier processing. In just a few minutes, the application process will complete.

Many institutions of finance also give free insurance for travel. This benefit is the most amazing for traveling lovers. Your vacations become more memorable when there is no burden on how to manage finances. With taking this loan to meet all the traveling expenses easily, the travel insurance is also beneficent.

Eligibility Criteria for Non-Listed Companies’ Employers

The proper knowing of the eligibility critical is very essential for every applicant who wants to get instant approval after applying. So, here, we are describing the general eligibility criteria for all non-listed companies’ employers.

Borrower’s income:

In the UAE, the number of banks & other lenders is more than any other country. All of them prefer to solve the financial issues of their clients. But, they also have criteria that make the applicants eligible. One of the criteria is the borrower’s income. For banks, the non-listed company is at a higher risk. Because they consider there is no guarantee that the borrower repay or not. As a result of this risky thought, the minimum limit for salary is higher for these borrowers. The listed companies get the advantage of applying this debt with a low monthly income as well.

Age limit:

The age limit for any kind of loan or any company in UAE must meet. Almost every lender’s criterion for age restriction is from 21 to 60 years. However, some also allow a maximum age of 65 years of the applicant. But, before reaching 65 years of age, the repayment must be cleared. If you think you can take a loan at this age with a longer tenure, then you will not get approval.

Experience of employment:

To increase your chance of qualification, it is necessary you have good experience of working in the company. The good history of longer employment is a positive point in getting the immediate approval of your application. When a bank will check your employment status, they will know you are a financially stable person. Furthermore, they give surety that you will repay the debt on time.

Credit scores:

In the UAE, credit scores are the most efficient contributor to making a person more eligible. The excellent credit scores of applicants show that they always maintain their payments without any delay. This point makes the applicant’s application more worthy of gaining personal debt.

Required Documentation for Personal Loans without company listing

When you check the eligibility criteria, now you must know the required documents. The required documentation without listing the company are:

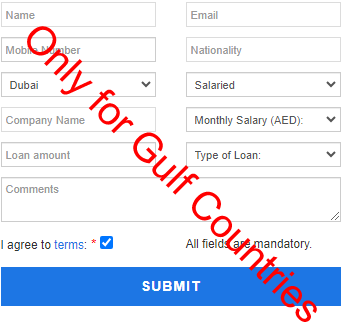

Application form:

The first step for the initiative of the process is filling out the application form. This form must fill with accurate personal details without any errors. You should check the form again after filling. So, there is no fault in any detail.

Salary transfer:

Some specific personal loan comes with the requirement of salary transfer. You need to transfer your salary to the selected bank. For this transfer, you have your personal account in that bank. With the application form and other documents, the attachment of the certificate of salary transfer is also essential.

Proofs:

There are documents that work as proof of the applicant’s identity. In these proofs, you will need to have copies of your ID, passport, visa, etc. Some government IDs are also required. All proofs must submit if the applicant works in a listed company.

Your bank statement:

The bank statements show the potential nature of the applicant toward earnings. Lenders demand your bank statement, so they easily know your details of banking history. It is helpful to gain the lenders’ trust in gaining the debt amount.

Factors to consider

After knowing the different aspects of personal loans, there are some factors that must consider. These factors ensure the choice of the perfect personal loan.

Compare prices:

The interest rate must be lower. That’s the reason the comparison between the lenders is important. When you compare the lenders, you will know which offers the debt with lower monthly installments.

Reviewing the loan’s terms:

The loan terms of every bank are specific. You have to review all the terms. So, you will know their basic rules also. It will reduce the chance of a loan default. Especially, it is mandatory for the non-listed company applicant. Thus, the borrower will not face any bad consequences.

Check out new products

When lenders disburse the amount, they give additional products to their clients. For instance, credit insurance is one of the top products. Besides, the banks also give service of payment protection to their clients. You should review every insurance term.

Selection of an interest rate type:

From the two types of interest rates, choose the one which is suitable for your finances. It is because every installment amount is with the amount of interest also. So, the lower interest amounts are with lower monthly installments. The types of interest are reducing and flat. Usually, the flat rate is lower than reducing. But, the reduction rate reduces after every payment.