Loan Refinancing in the UAE: Improving Loan Terms

Always choose a loan that is perfect for your financial budget because the repaying of monthly installments is compulsory. Otherwise, there is a chance of loan default and you will pay the debt amount with additional charges. Whenever you have difficulty with the payment of monthly installments, you should apply for Loan Refinancing in Dubai. It is an impressive solution to improve the loan terms. The refinancing option is only a way to avail of loans with improved and better terms. The financial company Loansforgulf considers the client’s need for finances and then offers favorable loan terms.

Loan Refinancing in Dubai

In Dubai, the loans are the most common financial services provided by the financial institutions. All lenders offer exceptional debt services because the large population of UAE contains expats as well. Expats choose this country to do work there. Therefore, many times, they need extra finances to financially settle in a new country. Both ex-pats & nationals avail loans according to their financial desires. But when they repay the debt installments, the borrowers face more burden of debt’s repaying rate. In this way, Buyout loan is an attractive option that is beneficial for borrowers’ financial lives.

How do loans Refinancing in Dubai work?

The complete procedure of refinancing a debt is the same for nationals & expats. You will obtain a new debt with better loans. Just like other loans, you will be required to submit the application form of debt with the attachment of all documents. The banks only approve the refinancing application when they verify that you are an eligible applicant. This new refinance debt comes with new terms and then you will pay the monthly installments accordingly. In addition, the sign on the agreement papers is compulsory so you must read it carefully before signing. It is helpful in saving your money because the new terms are lower rates and low payments.

When does a borrower need refinancing?

There are so many reasons why a borrower decides to apply for debt refinancing. All of these reasons are of great advantage. Check the below reasons when individuals need refinancing of loans:

For debt consolidation:

If you are in the situation of paying numerous repayments in a month, you will need a debt refinance to consolidate all of your existing debts. The cost of new debt is lower as compared to the combined cost of many debts. In particular, you can avail of this loan with the terms of your choice. Make sure the rates and interest are lower, so the debt will not become expensive for you.

Convert collateral loan into simple:

Sometimes, people take collateral debt because of their lower interest rate and when they want to purchase a home, vehicle, or any property. But if you are unable to pay the payments, you will lose your property because the lender has a right to seize your property. The new debt refinance does not need any collateral. With the taking of this fund, you can pay the existing collateral loans. And, then you will pay the monthly installments of this new loan.

Change the loan terms:

All kinds of loans come with specific terms and conditions. When the rates are higher and the repayment terms are also shorter, you are not capable of repaying the monthly installments on time. The lender may add penalty charges for the missing or delaying of the installments. Therefore, the refinancing of debts gives you the option to change the terms which is convenient for repayment. You can enhance or reduce the repayment duration according to your financial stability. Enhance this tenure if you want to pay lower payments and decrease this tenure if you want to pay less interest.

Switch the type of loan:

The loans come with two types of interest. One is fixed and the other is variable. The lender allows you to switch the interest type. For instance, if a borrower repays the debt amount with a variable rate, he can not predict the monthly payments. And, then he wants to convert this interest into fixed to manage his financial budget more wisely. It is possible with the availing of refinancing debt.

Steps to refinance loan in Dubai

The process of refinance loan is not complicated but every lender has their specific process. Loansforgulf’s professionals assist you in applying for this debt. Following are the basic steps for the refinancing:

Research options:

Firstly, research different options of lenders and their services of offering this loan. It helps in the choosing of the best lender. It is necessary to understand the lender’s terms and then make a final decision.

Get pre-approved:

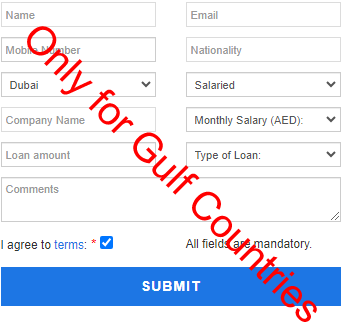

After choosing the lender, there is a requirement of pre-approved to get access to a new loan. This step involves filling out the application form, submitting documents, etc. The documents include the applicant’s proof documents of residency, financial, etc.

Sign the loan documents:

When your application gets approved, the next step is to sign the agreement documents of the debt that you will obtain. At that time, you will pay the closing costs. Without paying closing costs, you will not get access to funds. After signing the documents and paying off this cost, your existing debt will be paid down and you will repay the payments of new debt. This new refinance choice comes with good terms that ensure you will conveniently pay down the debt amount.